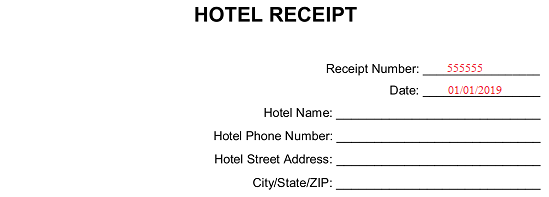

by Regents Risk Advisory | Nov 29, 2010 | Cyber-Threat, Forensic Data & Cyber Threats, Investigation & Background, Pre-Employment Screening

Just how far should background screening delve into the private lives of candidates? If you want to be a Police officer candidate for some Police Departments in the US, you may have to undergo some deep digging into your background. The International Association of...

by Regents Risk Advisory | Nov 26, 2010 | Fraud & Integrity, Fraud Money Laundering

Counter-terrorism officer Detective constable Daren Pooley has been jailed for defrauding the U.K. London Metropolitan Police Force out of £93,000 [about US$ 146,000] via a property scam during the 7 July bombings investigation. Pooley was sentenced to three years’...

by Regents Risk Advisory | Nov 21, 2010 | Corporate Fraud Investigations, Cyber-Threat, Forensic Data & Cyber Threats, Fraud & Integrity

In 2010, typed passwords remain the principal method for logging into various accounts on the internet. Despite the critical part that passwords play in securing access to email, FaceBook or Bank accounts, many users still use unsuitable and simple passwords. The...

by Regents Risk Advisory | Nov 15, 2010 | Business Intelligence, Intellectual Property, Investigation & Background

McDonald’s may be the preeminent name in fast-food but that doesn’t necessarily mean that it can claim to possess the `Mc’ prefix for the name of any restaurants. Not in Malaysia, anyway. McDonald’s in Malaysia waged an eight year legal battle against food outlet...

by Regents Risk Advisory | Nov 14, 2010 | Cyber-Threat, Forensic Data & Cyber Threats, Investigation & Fact Finding, Locating People

Geotags are the small amount of metadata contained within a digital photo or video file which records the exact longitude and latitude of the location that the images were taken. Geotags are a useful tool for anyone wanting to identify where their own multiple photos...